Blend.ph: What It Takes To Be A Small Franchise Business

A small franchise cart as an entrepreneurial model may seem easy manage on the outset. But, are you fully prepared to start one and keep it going so that it can be a major income stream? Becoming a franchisee requires learning the ropes of the business, getting dedicated staff, and having sufficient funds. Even with minimal cash at hand, many Filipinos nowadays have started a business from home. Either, in their garage or a nearby high-traffic area. Of course, all of this comes with the hope of augmenting their income to sustain their families. Some have opted to take the franchising route, taking their pick from among the food and non-food categories. Yes, there are affordable food franchise offerings, if you just look around you.

Other service industries, like cleaning services, have also been in demand even during the pandemic. Laundromats and home cleaning franchises have rolled out targeted services to help dwellers maintain cleanliness and stamp out coronavirus. Whatever specific product and service you choose, you need to venture into the franchising game with your eyes open. And, of course, with your pockets ready. Seasoned entrepreneurs share that the only way to build wealth is to live frugally. And, be able to compartmentalize business from personal spending. Some have expanded in just a matter of months. Meanwhile, others advise not expanding too fast, and check first how saturated an area is before bringing a business there.

Blend.ph: What It Takes To Be A Small Franchise Business

As with any other investment, running a franchise cart, kiosk, or using part of one’s home for a franchise business comes with risks. So, you have to know your tolerance for it.

Franchise coach Rick Bisio said in his book The Educated Franchisee: The How-To Book for Choosing a Winning Franchise,

“Owning a business is not fundamentally risky, it’s the way that we interact with the environment, the knowledge we gather and the safety nets that we establish that determine the level of risk.”

It takes guts, patience, hard work, and funding. Before the business can evolve into something big, you need to commit time, energy and money for it. The franchise model has inherent advantages. The franchisor has done much of the initial work on acquiring a captive market, establishing the brand, and testing the market first-hand. The franchisor’s support remains generally assured. Before even signing that franchising agreement, you need to do your homework. Read extensively about industry trends keep an alert eye on hot franchise opportunities. Of course, this includes which areas they have penetrated. You also need to know what consumers really want. And, be ready to provide good service. Business owners need to free up their time to focus on growing the business and staying attuned to the market pulse.

For the funding, aspiring franchisees may borrow from family and friends, or contact organizations that crowdfund for businesses and franchises. Starting a small franchise venture is very doable. Franchisees oftentimes put together financing options that combine personal savings. This includes company incentives earned, some help from immediate family, and a franchise loan from alternative avenues, such as a peer-to-peer funding platform.

In the Philippines, trusted peer-to-peer lending platforms like Blend.ph can customize your business loan to fit your financial purpose and translate your dream business to reality.

A franchise loan obtained from Blend.ph generally has a two percent interest rate. And, loanable amounts range from 50 thousand pesos to two million pesos, with a payment term of 12-36 months. Blend PH’s online franchise loan is the best online loan Filipinos can avail. Its terms and repayments remain flexible. Once approved, your borrowed capital will be disbursed directly to your chosen Blend PH franchise partner. People may be apprehensive about raising funds, or to take the risk to build an income-generating business, but with Blend.ph, the door to opportunity can be opened.

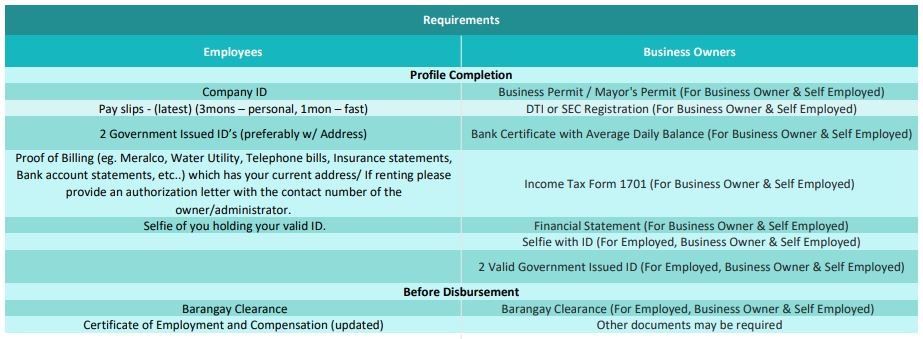

Here are the details of Blend.ph’s Franchise Loan:

The advantage of an online funding platform is that borrowers skip the lines of processing and just need to accomplish the online franchise loan application without leaving the comforts of home. Read the frequently asked questions about franchise loan at www.blend.ph/franchise-loan/ or send Blend.ph a direct message at its official FB page, or email support@blend.ph.

Aside from being a businessman, Josh Austria has been working in PR and media industry for more more than a decade. From his years of experience as the Marketing and Advertising Head of Village Pipol Magazine, he has built strong relationships with creative people, brands, and organizations.